From Mod to Member: Control, Fair Pricing, and Safer Outcomes in WC Captives

Part 3: The Edge: Control, Fair Pricing, and Safer Outcomes in WC Captives

What You Actually Get When You Stop Paying Traditional Premiums

In Parts 1 and 2, we covered who's a fit for group captives and how the mechanics work. Now comes the practical question: What changes when you move from traditional workers' comp to a captive structure?

The answer isn't just "lower costs" (though that often happens). The real advantages run deeper: you gain control over coverage terms, your premiums reflect your actual performance instead of industry trends, and you get complete transparency into where every dollar goes.

More importantly for workers' comp, the financial alignment creates measurably safer workplaces. One survey found that captive participants experienced 48% fewer fatalities and 22% fewer workers' compensation claims compared to their traditionally insured counterparts.

Let's break down why captives deliver these outcomes and what they mean for your business.

Advantage #1: Greater Control Over Coverage Terms

Traditional workers' comp policies are standardized products. You get what the carrier offers, with limited ability to customize terms, deductibles, or coverage specifics. If you want something different, you're often out of luck or paying steep premiums for endorsements.

In a captive, you have control.

Because you co-own the insurance subsidiary, you have a voice in how policies are structured. This matters especially for:

Deductible and retention levels. You can choose higher retentions if you're confident in your safety program, reducing premium costs while maintaining coverage for catastrophic claims.

Return-to-work provisions. Captives can build in explicit support for modified duty programs, transitional work arrangements, and early intervention strategies that reduce claim duration and severity.

Medical provider networks. You can work with your captive's third-party administrator (TPA) to negotiate relationships with preferred clinics, occupational health providers, and case management firms that align with your return-to-work philosophy.

Coverage for unique risks. If your industry has specific exposures that traditional carriers either exclude or price prohibitively, a captive (especially a homogeneous one) can structure coverage that actually addresses those risks.

This control doesn't just feel better. It translates into better outcomes. When you can design coverage around your actual operations rather than accepting a one-size-fits-all policy, you get protection that works the way your business works.

Advantage #2: Business-Specific Premiums (Your Risk, Not Industry Averages)

Here's how traditional workers' comp pricing works: your premium is based partly on your experience mod and loss history, but also heavily influenced by industry classification rates and market conditions.

If your industry is having a bad year (high claim frequency, expensive settlements, regulatory scrutiny), your rates go up even if your business is performing well. You're subsidizing the poor performance of other companies in your class code.

Captive pricing flips this model.

Your premiums are calculated based on:

- Your actual loss history (not aggregated industry data)

- Your specific risk profile (your safety programs, your facilities, your workforce)

- Your claims management performance (how quickly you close claims, your return-to-work success)

This is often called premium allocation in captive structures. Each member's contribution reflects their individual risk, adjusted annually based on actual performance.

If you're running a safer-than-average operation, you're no longer paying for everyone else's claims. You're priced fairly based on your results.

And because you retain any underwriting profit (the difference between premiums collected and claims paid), you directly benefit from staying below your loss expectations. Traditional insurance keeps that profit. In a captive, it becomes surplus that can eventually be distributed back to you.

Advantage #3: Cost Reduction Through Fewer Claims and Retained Profit

The captive structure creates a powerful financial incentive: every prevented claim improves your bottom line.

In traditional insurance, there's a disconnect. Yes, fewer claims help your mod and may reduce future premiums. But the immediate financial benefit goes to the carrier, not you. You're still paying the same premium this year regardless of whether you have zero claims or ten.

In a captive, the math changes instantly.

Lower claims mean:

- Less money paid out from the captive's reserves

- More surplus accumulation at year-end

- Potential profit distributions back to members

- Stronger financial position for future underwriting

This creates what insurance economists call "alignment of incentives." Your financial interest and the captive's financial interest are the same because you're the owner.

The result? Businesses in captives invest more heavily in:

- Safety training and equipment

- Ergonomic assessments and workplace modifications

- Early reporting and intervention protocols

- Return-to-work programs that reduce claim duration

- Proactive risk management rather than reactive claim handling

These investments pay off. The 48% reduction in fatalities and 22% reduction in workers' comp claims among captive participants isn't accidental. It's the natural outcome of properly aligned incentives.

Advantage #4: Transparency Into Every Dollar

Traditional workers' comp is opaque. You pay a premium, file claims, and get periodic statements. But you never really see:

- How much the carrier spent processing your claims

- What administrative overhead was charged

- How reserves were calculated

- Where your premiums went beyond paid claims

- What profit margin the carrier earned on your account

Captives operate in full transparency.

As a member-owner, you have access to:

- Detailed claims reports showing every open and closed claim, reserves, and settlement amounts

- Premium allocation breakdowns showing how your contribution compares to actual losses

- Administrative cost statements detailing TPA fees, actuarial costs, regulatory fees, and management expenses

- Reserve development showing how initial reserves compare to ultimate claim costs

- Surplus calculations showing underwriting profit and investment income

- Reinsurance costs and recoveries if your captive purchases aggregate stop-loss or specific excess coverage

This transparency doesn't just satisfy curiosity. It enables better decision-making.

When you can see exactly which claim types are driving costs, you can target safety interventions more precisely. When you understand how quickly claims are closing, you can evaluate your TPA's performance objectively. When you know what medical providers are costing per case, you can negotiate better relationships.

Transparency turns insurance from a black box into a management tool.

|

Advantage |

Traditional Workers’ Comp |

Captive Insurance |

Value to You |

|

Greater Control Over Coverage Terms |

Standardized policies with little customization. Endorsements are costly. |

Members co-own the captive, shaping policy terms, deductibles, return-to-work provisions, provider networks, and unique risk coverage. |

Coverage tailored to your business, not industry averages. Policies align with your operations and goals. |

|

Business-Specific Premiums |

Premiums heavily influenced by industry averages and market trends. Safer firms subsidize riskier ones. |

Premiums calculated from your actual loss history, safety record, and claims performance. Profits retained by members. |

Fair pricing that rewards your results and safety investments. |

|

Cost Reduction Through Fewer Claims & Retained Profit |

Premiums stay flat regardless of claims. Carriers keep underwriting profit. |

Every avoided claim grows captive surplus. Profits can be distributed back to members. Incentives align to reduce claims. |

Direct financial rewards for proactive safety and risk management. |

|

Transparency Into Every Dollar |

Opaque. Carriers don’t disclose claim handling costs, reserves, or profit margins. |

Full access to detailed claims reports, premium allocation, administrative costs, and surplus calculations. |

Turn insurance into a management tool with data-driven insights. |

How Captive Funding Structures Reduce Workers' Comp Volatility

Understanding how captives handle funding and reinsurance protection helps explain why they're often more stable than traditional insurance.

Fronting Arrangements

Many captives use a fronting carrier: a licensed insurance company that issues the policy and handles statutory obligations. The fronting carrier then cedes most or all of the risk back to the captive through a reinsurance agreement.

This structure provides regulatory compliance (not all states allow direct writing by captives), streamlines claims administration, and gives claimants a recognized carrier name to work with. The fronting carrier typically charges 5-10% of premium for this service.

Aggregate Stop-Loss and Specific Excess Coverage

To protect against unpredictable loss years, captives purchase aggregate stop-loss reinsurance that kicks in when total claims exceed a predetermined threshold (often 125-150% of expected losses).

Captives also carry specific excess reinsurance covering individual large claims above a certain threshold (typically $250,000 to $500,000 per occurrence). This protects against catastrophic injuries like traumatic brain injuries, spinal cord injuries, or fatalities that could otherwise destabilize the captive.

Collateral Requirements

When you join a captive, you may be required to post collateral (funds or a letter of credit) as security for your share of potential claims. This ensures the captive has liquid assets to pay claims promptly and aligns member interests.

Collateral amounts are typically a percentage of your annual premium or estimated loss exposure. The funds remain yours, earn interest, and can be released over time as claims develop and reserves are no longer needed. It's not an additional cost, but it does affect cash flow and capital allocation.

Safety Incentives Create Measurably Better WC Outcomes

The reduction in fatalities and reduction in workers' comp claims among captive participants reflects a fundamental truth: when business owners have direct financial exposure to claim outcomes, they invest more aggressively in prevention.

Faster Return-to-Work Programs

In a captive, every day an injured worker remains off work costs you money directly. This creates powerful motivation to establish transitional duty programs, maintain relationships with treating physicians who understand modified work, and track claim duration metrics closely. The result? Claims close faster, disability costs drop, and injured workers return to productive employment sooner.

Proactive Medical and Safety Management

When you're writing checks directly from your captive, you care deeply about medical costs. Captives negotiate with occupational medicine clinics that emphasize functional restoration, employ nurse case managers who coordinate care, and monitor pharmacy practices closely.

Because captive members keep underwriting profit, they're more willing to invest upfront in safety: ergonomic workstations, fall protection equipment, fleet safety technology, and formal safety committees with real budgets. These investments have positive ROI when the savings flow to your surplus rather than a carrier's profit margin.

Data-Driven Safety Culture

Transparency enables measurement, and measurement drives improvement. Captive members can see claim frequency by location and department, leading indicators before they become compensable injuries, and cost drivers by injury type. This data allows targeted interventions exactly where they're needed.

Claim Closure Rates and Better Service Provider Decisions

Claim closure rate directly impacts surplus accumulation and eventual dividend distributions. Claims that linger open tie up reserves even if they're not actively paying benefits. Fast closure releases those reserves to surplus.

Captive members who focus on aggressive return-to-work programs, proactive settlement negotiations, and effective TPA performance consistently outperform in dividend distributions.

Transparency also changes how you interact with service providers. In a captive, you have visibility into TPA performance metrics like average days to first contact, claim closure rates by adjuster, and reserve accuracy. If your TPA underperforms, the captive can switch providers. You have leverage because you're the customer, not just a policyholder.

The same accountability applies to medical providers. When you can see which clinics generate high costs or poor return-to-work outcomes, you can shift relationships to better partners.

Why This Matters: The Cumulative Effect

Individually, each advantage may seem incremental. Better control over deductibles. Slightly lower premiums based on your loss history. More visibility into claims.

But these advantages compound.

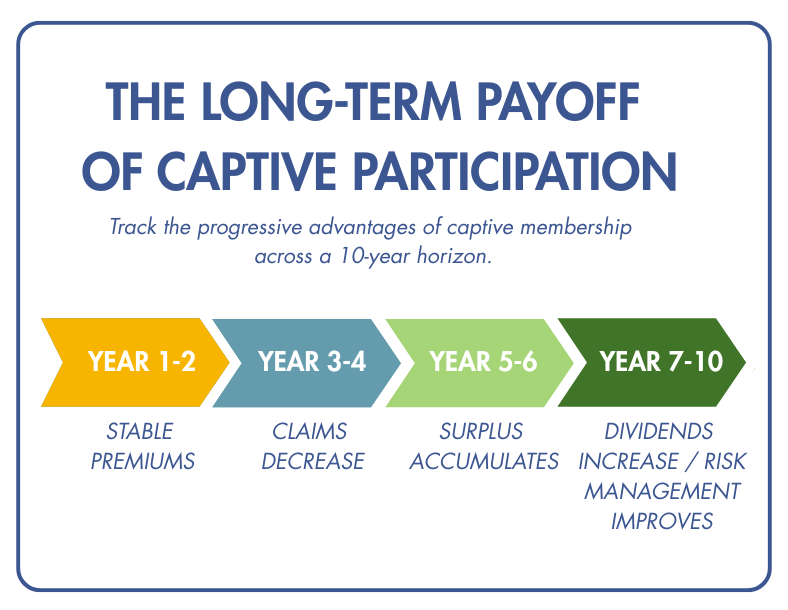

Over 5-10 years in a captive:

- Your premiums stay stable (or decline) because you're not subject to market cycle volatility

- Your claims decrease because safety investments pay off and return-to-work programs mature

- Your surplus accumulates because lower claims mean higher underwriting profit

- Your dividends increase because sustained performance earns profit distributions

- Your risk management improves because transparency enables better decisions

The businesses that benefit most from captives aren't looking for a quick premium cut. They're building a long-term risk financing strategy that rewards good performance and gives them control over outcomes.

Ready to See If You're a Fit?

If greater control, fair pricing, and measurably safer outcomes sound like advantages your business should have, the next step is determining whether you qualify for captive membership.

Take our online assessment. It evaluates your premium levels, loss history, and risk profile to determine if a workers' comp captive makes sense for your situation. Start the online assessment →

Already completed the assessment and want to go deeper? Download the complete guide: Putting a Property and Casualty Group Captive to Work for Your Business.

Have specific questions about how captive funding, collateral, or reinsurance structures work for your industry?

Schedule a consultation with one of our captive specialists.