Protecting Your Business Requires More Than Just Insurance

Insurance is essential for protecting your business, but relying solely on it could leave you exposed to unnecessary risks and costs. At Winter-Dent, we believe there’s a better way to safeguard your business. By flipping the traditional insurance pyramid, we focus on proactive prevention and cost-effective risk management strategies, offering you greater control and value.

If you want to move beyond reactive policies and create a safer, more resilient business, read on to learn how this innovative approach could transform the way you manage risk.

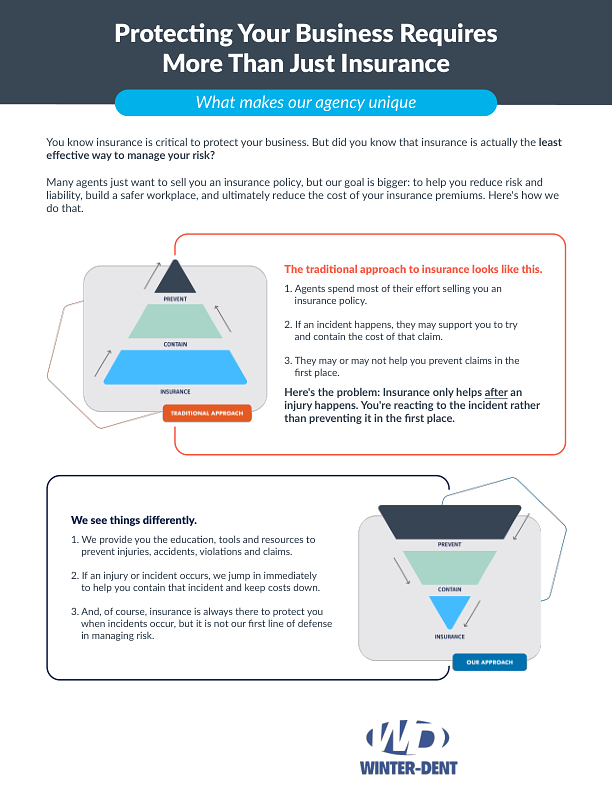

Rethinking the Traditional Insurance Approach

Most insurance agencies follow a predictable approach that sounds good on paper but leaves businesses vulnerable in practice. Here’s how the traditional insurance pyramid works:

1. Selling Policies First

Agents focus the bulk of their efforts on selling you an insurance policy. Insurance becomes the primary focus, leaving little room for proactive risk prevention.

2. Reactive Claims Handling

When an incident occurs, the agency helps you mitigate the claim’s cost. However, the keyword here is “reactive”-they step in only after an issue has already disrupted your operations.

3. Minimal Prevention Efforts

Traditional agencies rarely invest in preventative measures. This means you continually pay premiums without reducing the risk of incidents happening in the first place.

The result? Businesses are left playing defense, addressing issues as they arise rather than preventing them entirely. Not only does this come at a greater financial cost, but it also creates unnecessary stress and unpredictability for business owners.

Flipping the Insurance Pyramid

At Winter-Dent, we take a completely different approach. By flipping the traditional insurance pyramid, we prioritize proactive risk management strategies over simply selling policies. Here’s how our system works at every level of the pyramid:

1. Prevention First

Proactive prevention is the foundation of our approach. We arm businesses with the tools, education, and resources needed to prevent injuries, accidents, and violations before they occur. This includes:

- Comprehensive safety programs tailored to your industry.

- Compliance support to ensure you meet regulations.

- Employee training to create safer work environments.

By focusing heavily on prevention, we help businesses reduce both the frequency and severity of claims over time.

2. Immediate Incident Response

When incidents do occur, our team jumps in immediately. Our expert claims advocacy ensures early intervention strategies to contain costs and minimize disruptions.

3. Strategic Insurance Solutions

Insurance has its role, but it’s no longer the centerpiece of your risk management strategy. Instead, we use insurance in a calculated, strategic way to cover risks that cannot be mitigated through prevention.

Why Flipping the Pyramid Works

Adopting this prevention-first approach offers several tangible benefits for your business. Focusing on prevention reduces the overall expense of managing risks over time, resulting in fewer claims and lower premium costs that keep more money on your bottom line. Proactive strategies minimize both the likelihood of incidents and their impact when they do occur.

A strong loss history leads to better insurance pricing and terms from carriers during underwriting. You also gain more control of your risk management strategy instead of relying solely on an unpredictable insurance market. Ultimately, this comprehensive approach creates a long-term strategic advantage, particularly for businesses with loss-sensitive insurance programs.

Why Partner with Winter-Dent

At Winter-Dent, we're more than just an insurance provider—we're your risk management partner. Our mission is to help businesses build safer workplaces, reduce liabilities, and save money on insurance premiums. We make a difference by using cutting-edge analytics to identify the specific drivers of your claims and implement targeted strategies to address them. Every business is unique, so we design safety and loss prevention programs tailored to your specific needs. When incidents do occur, we take immediate action, advocating for your business and minimizing costs through effective claims management. For qualified businesses, we explore innovative risk financing options, such as captives, to provide cost-effective coverage. Throughout our approach, we treat insurance as one tool in a larger toolbox, utilizing it strategically to cover only the most critical areas of risk.

At Winter-Dent, we don't just sell insurance—we help you build a comprehensive risk management strategy that protects your business, your employees, and your bottom line.

Take Control with Winter-Dent

We understand that protecting your business is about more than just policies and premiums. It means creating a risk management strategy that safeguards your employees, assets, and future.

If you’re ready to say goodbye to the traditional insurance approach and build a safer, more efficient business, Winter-Dent is here for you. Contact us today to learn more about flipping the insurance pyramid and taking control of your risk management strategy.