According to the Federal Emergency Management Agency, 25% of businesses do not reopen after a major loss due to a disaster. How would your business be impacted if critical physical assets were lost to natural disasters or other perils? Assets make your business run; buildings, raw materials, equipment, vehicles, and inventory. What is the process you use to ensure protections are in place to protect your critical physical assets? Don't let your business become a statistic. Utilize 4sight™ Risk Optimization to ensure your business can recover from a major interruption or loss.

4sight™ analysis can bring into focus areas of your business that may be vulnerable to interruption - let’s take a look through the 4sight™ Physical Risk lens!

Are Your Business's Physical Assets Properly Valued?

According to a survey by Marshall & Swift, 75% of businesses in the U.S. are underinsured by 40% or more. One of the benefits of 4sight™ is access to analysis which drives education and awareness regarding risks that can potentially disrupt your business. Consider catastrophic loss and insurance to value.

- If a major loss were to occur, what is the estimate of the current cost to replace or rebuild a property considering material and labor expenses, design and build services, etc.?

- How quickly could you resume revenue-generating business activities under a loss scenario where your out-of-pocket expense is 40% of property repair/replacement costs?

The 4sight™ Risk Optimization process gives you confidence that your physical assets are appropriately valued, and business insurance coverages align with your risk tolerances.

Can your Business Withstand a Temporary Loss of Revenue?

Consider the temporary loss of a revenue-generating physical asset (e.g., fleet vehicle, skid steer, fabrication equipment, specialized machinery, etc.).

- Can your business withstand the temporary revenue loss in addition to the potential asset repair/replacement costs?

- What controls do you have in place to ensure revenue stream integrity?

4sight™ analysis is designed to provide you with an understanding of how critical assets can impact the continuity of your business. Knowing which assets are critical can help you define risk tolerances, establish controls, and allocate resources appropriately.

Build Resiliency to Business Interruption with 4sight™ Risk Optimization

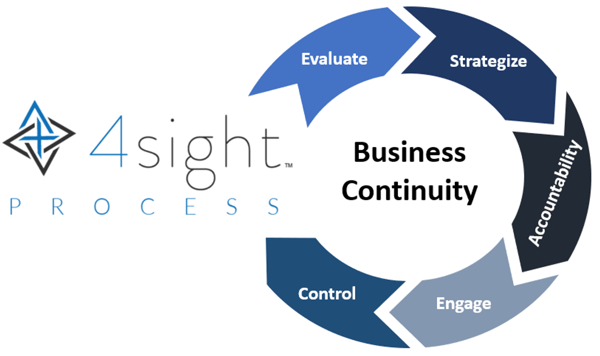

What business interruption scenarios are credible for your business? Consider property damage due to severe weather, machinery breakdown, supply chain issues, labor disputes and other perils. The 4sight™ process can help you determine which scenarios are credible and help you stress test your business’s resilience. Resiliency is built through layers of protection, including risk tolerance assessment, proactive exposure controls, and risk transfer.

Does your business have a process and plan in place to ensure operational continuity in the event of a business interruption?

The Winter-Dent 4sight™ Resource Team is available to help you understand your exposures and build the layers of protection needed to mitigate your business interruption risks.